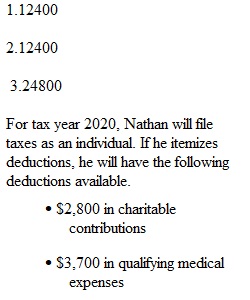

Q Question 1. Version 2*/2. Score: 1/1Expand The following table shows the standard deductions for tax year 2020. Standard Deductions Single Married Filing Jointly $12,400 $24,800 For tax year 2020, Nathan will file taxes as an individual. If he itemizes deductions, he will have the following deductions available. • $2,800 in charitable contributions • $3,700 in qualifying medical expenses • $1,600 in business expenses What is the amount of Nathan's 2020 deduction? Question 2. Version 1*/1. Score: 1/1 The following table shows the standard deductions for tax year 2020. Standard Deductions Single Married Filing Jointly $12,400 $24,800 For tax year 2020, Erick will file taxes as an individual. If he itemizes deductions, he will have the following deductions available. • $4,200 in business expenses • $3,600 in childcare expenses • $5,200 in mortgage interest What is the amount of Erick's 2020 deduction? Question 3. Version 1*/1. Score: 1/1 The following table shows the standard deductions for tax year 2020. Standard Deductions Single Married Filing Jointly $12,400 $24,800 For tax year 2020, the Jacksons will file taxes as a married couple. If they itemize deductions, they will have the following deductions available. • $3,200 in mortgage interest • $7,300 in qualifying medical expenses • $5,900 in childcare expenses What is the amount of the Jacksons's 2020 deduction? Question 4. Version 1*/1. Score: 1/1 The following table shows the standard deductions for tax year 2020. Standard Deductions Single Married Filing Jointly $12,400 $24,800 For tax year 2020, the Campbells will file taxes as a married couple. If they itemize deductions, they will have the following deductions available. • $5,900 in educational expenses • $11,000 in business expenses • $11,400 in property taxes What is the amount of the Campbells's 2020 deduction? Question 5. Version 4*/4. Score: 4/4Expand Use the 2020 tax information below to answer this question. Tax Rates Rate Single Married Filing Jointly 10% $0 - $9,875 $0 - $19,750 12% $9,875 - $40,125 $19,750 - $80,250 22% $40,125 - $85,525 $80,250 - $171,050 24% $85,525 - $163,300 $171,050 - $326,600 32% $163,300 - $207,350 $326,600 - $414,700 35% $207,350 - $518,400 $414,700 - $622,050 37% $518,400 or more $622,050 or more Standard Deductions Single Married Filing Jointly $12,400 $24,800 Brenda is a 26-year-old, full-time college student sharing rent with a roommate who is filing separately from Brenda. Brenda made $14,800 at her part-time job in 2020. She does not have any adjustments or itemized deductions. Find Brenda's taxable income. Round to the nearest cent. $ Correct Brenda qualifies for a $78 earned income tax credit. Compute Brenda's tax owed. Round to the nearest cent. $ Correct Suppose Brenda's W-2 says that she paid $370 in taxes in 2020. Does Brenda owe taxes, or is she due a refund?

Q Question 6. Version 3*/3. Score: 7/7Expand Use the 2020 tax information to answer these questions. Tax Rates Rate Single Married Filing Jointly 10% $0 - $9,875 $0 - $19,750 12% $9,875 - $40,125 $19,750 - $80,250 22% $40,125 - $85,525 $80,250 - $171,050 24% $85,525 - $163,300 $171,050 - $326,600 32% $163,300 - $207,350 $326,600 - $414,700 35% $207,350 - $518,400 $414,700 - $622,050 37% $518,400 or more $622,050 or more Standard Deductions Single Married Filing Jointly $12,400 $24,800 The Nelsons are a married couple with a combined income of $47,500. They have one child with a health condition, and can claim the following deductions: • $4,500 in property tax • $6,500 in mortgage interest • $2,000 in charitable contributions • $10,000 in qualifying medical expenses They can claim a $2000 child tax credit, and are eligible for an Earned Income Credit of $23. Will the Nelsons use the standard deduction or itemized deductions?

View Related Questions